How to make profits via Shopify dropshipping? Does dropshipping still profitable in 2022? If you are still unsure about the ecommerce market, you can take a look at the global e-commerce market trend in 2022. In 2022, global e-commerce sales are expected to exceed US$5 trillion for the first time, accounting for one-fifth of total retail sales, and in 2025, this figure is expected to exceed US$7 trillion. The epidemic has brought uncertainty to the global economy, but the e-commerce market has ushered in a period of rapid growth. In the eyes of consulting agencies and data research companies, the e-commerce market has a bright future. The e-commerce market is expected to continue to grow through 2025. This report produced by eMarketer provides the latest forecasts for total retail sales, e-commerce sales, retail mobile commerce and online consumer volume around the global, regional and country dimensions.

After 2 years of “savage growth”, global retail sales are expected to plateau in 2022, and total retail sales are very impressive even in the context of slowing growth. This report will focus on the following three points:

What is the prospect of the global retail industry and e-commerce market after 2022?

What changes will the total sales of e-commerce in different countries and regions usher in 2022 to 2025?

How many consumers are expected to switch to online consumption in 2022?

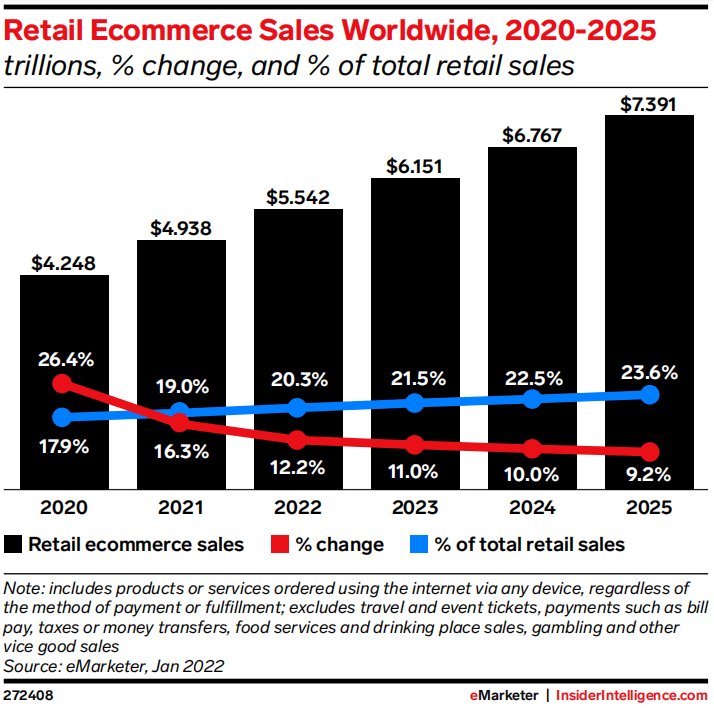

(The picture shows the trend of global e-commerce sales, the red curve represents the trend of increase and decrease in global e-commerce sales, and the blue curve represents the trend of global e-commerce sales as a percentage of global total sales. Note: Global e-commerce sales The amount refers to the sales generated by the purchase of services or products through the Internet or other devices and channels, and the handling fees and taxes generated by travel tickets, event bookings, and online consumption will not be counted. Source: eMarketer , January 2022)

The key points of the global E-commerce market trend in 2022 are:

1>Growth in e-commerce sales will slow sharply. Global e-commerce sales are expected to grow by 12.2% in 2022. Compared with the data of the past two years, the guarantee is slightly thin, and the increase of 12.2% still means that the online spending in 2022 will be 603.68 billion US dollars more than that in 2021, which is the largest increase on record;

2>Offline stores bottomed out and rebounded more than expected. In 2021, the recovery of offline channels far exceeded expectations, recovering two years earlier than the initial forecast and even surpassing the level before the epidemic. In the future, the growth rate of e-commerce will still be faster than that of physical stores, but the gap between the two will narrow;

3>Emerging economies will be revived due to the rapid growth of the e-commerce market in the local area. In the early days of the epidemic, the e-commerce market in both developed and developing countries ushered in substantial growth. In 2022, several countries from the Asia-Pacific and Latin America regions will occupy a large number of the 10 fastest-growing e-commerce countries;

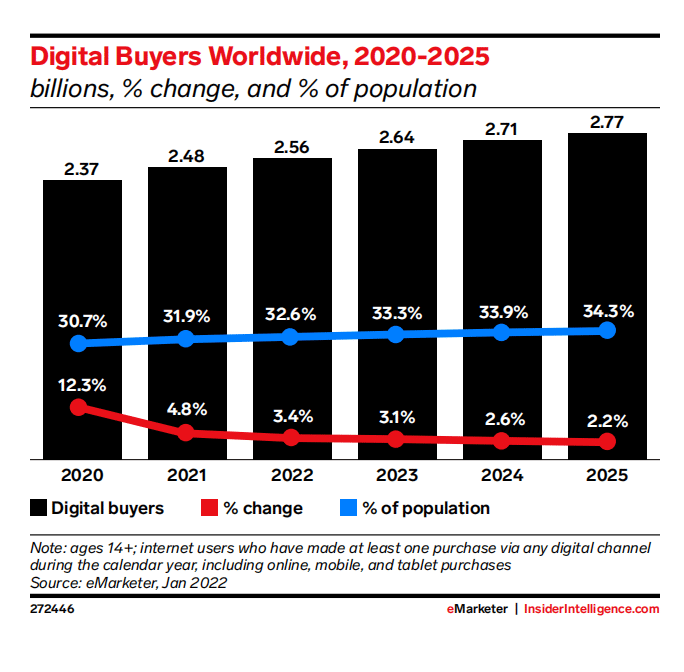

4>The growth rate of the number of online consumers slowed down to about 2.56 billion. In 2022, about 2.56 billion people in the world will shop online, but the growth rate will only be 3.4%, which is the first time on record. New online shoppers are mainly from India, Indonesia, Brazil and some other emerging markets.

(*The forecast data in this report is based on an analysis of 7,294 data points from 637 sources, including estimates from third-party research firms, data released by the retail industry, government data covering macroeconomic conditions, and Incorporating sales data and data released by major online retailers. The report also incorporates relevant consumer buying trends and their preferences for mobile device usage, which can be a very important role used to stimulate consumer acceptance, choice, and deep bundling of online shopping.)

The Global E-commerce Market in 2021

The expected increase in global e-commerce sales in 2022 fell to 12.2%, which is not even half of the average of the past 10 years. To some extent, it does provide data support for the remarks that the dividend period of the e-commerce market in 2021 may be over. In the next few years, global e-commerce sales will still maintain a low double-digit growth rate. Since the base has reached a certain volume, it is expected that the annual new sales will still exceed 5 trillion US dollars.

Global e-commerce sales have grown by more than 20% every year since tracking data in 2011, but 2021 is an exception. 2020 was supposed to be an inflection point for the slowdown in the growth of the e-commerce market, but the sudden outbreak of the epidemic has sharply reduced the market share of physical store consumption. Despite the economic downturn in various countries affected by the epidemic, the e-commerce market in many countries has bucked the trend during this period.

The e-commerce market in 2021 has inherited the brute force in 2020, but the growth rate has still dropped to 16.3% (the previous forecast released in May 2021 was 16.8%). In 2022, the growth rate in most countries is expected to be lower than the global growth rate in 2021, but digital transformation is the general trend.

Global E-commerce Market in 2022

1>Global e-commerce sales will reach $5.542 trillion in 2022, up from $4.938 trillion in 2021. It is expected that after breaking the US$5 trillion mark in 2022, it will exceed US$6 trillion in 2023 and US$7 trillion in 2025.

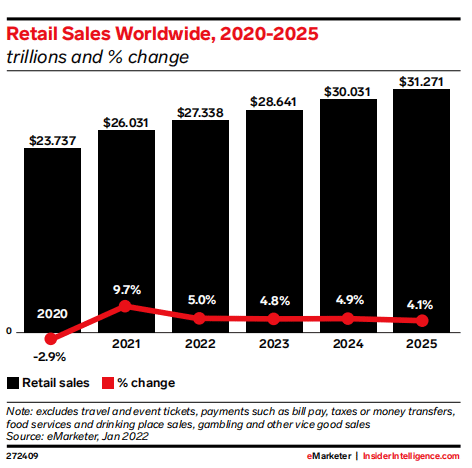

2>Retail stores’ contribution to the global retail market in 2021 is much higher than expected. In the context of the strong return of consumption in physical stores, total global retail sales in 2021 will increase by 9.7%, exceeding the forecast of previous analysts.

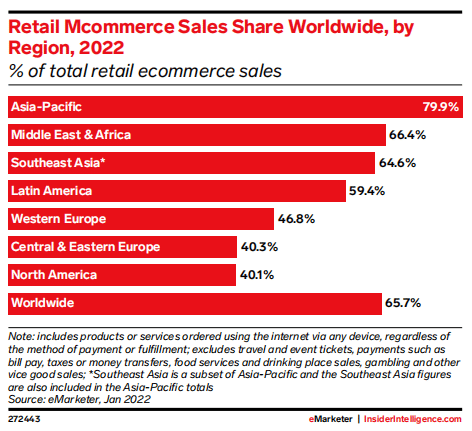

3>The growth of mobile e-commerce (defined as the use of mobile devices such as mobile phones and tablets to conduct business transactions through mobile networks) has slowed. In 2022, mobile e-commerce will account for 65.7% of global e-commerce, and the room for growth of this number will become very limited in the future.

The growth rate of the e-commerce market will slow down in 2022, but the overall consumer market is still full of vitality

10 years ago, global retail sales were just over $16 trillion, and global consumer spending on online shopping in 2022 will increase by $603.68 billion compared to 2021. By 2025, the figure will be as high as $7.391 trillion. In 2022, e-commerce sales will account for more than 20% of the total global retail sales, which will achieve a great leap forward. It accounts for less than 15% of total retail sales.

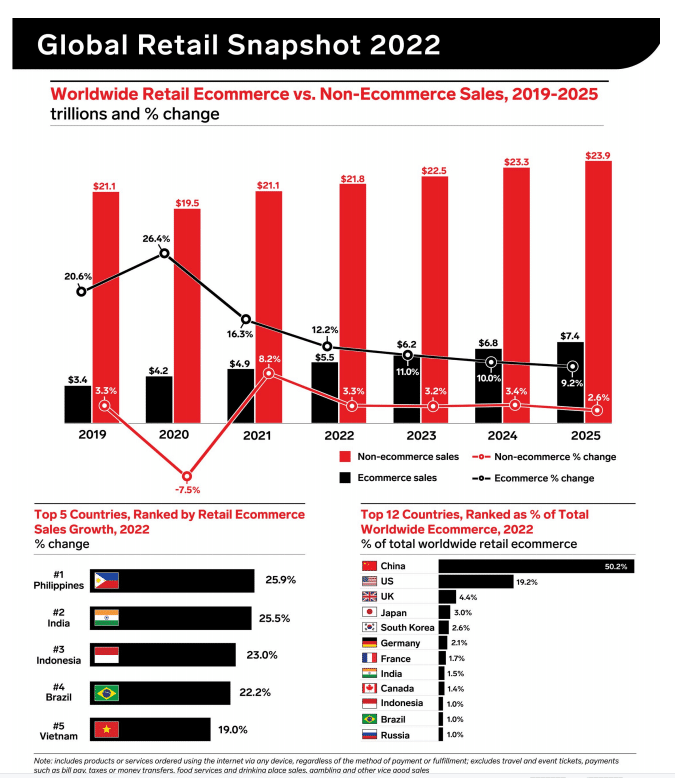

(The top is the trend of e-commerce sales (black curve) and non-e-commerce sales (red curve) year by year; the bottom left is the top 5 countries with the highest e-commerce sales growth in 2022; the bottom right is the domestic e-commerce market share The top 12 countries with the highest share of total domestic retail sales. Image source: eMarketer)

In 2021, the gap between global retail and e-commerce sales growth will shrink to 8.1%, the lowest on record. In contrast, the 33.9% gap between the two in 2020 is “abnormal”. The gap between the two will continue to the 2021 level in the next few years.

In May 2021, eMarketer had forecast an annual increase of 6.0% in total global retail sales, just over $25 trillion, but it ended up with a 9.7% increase, which was higher than expected. Total global retail sales reached $26.031 trillion. From this, it can be concluded that the contribution of the real economy to the recovery of the consumer market cannot be underestimated.

The retail sales rebounded by 8.2% in 2021 to $21.094 trillion, surpassing the total global retail sales in 2019. it is expected to grow between 2.6% and 3.4% by 2025. Although retail sales is growing at a slower pace, new additions in 2022 will still be higher than e-commerce sales (the former is expected to be $702.17 billion, the latter about $603.68 billion).

The share of mobile e-commerce in total e-commerce sales keeps growing, but tends to slow down

Netizens in North America and Europe have become accustomed to using mobile devices to consume, but more often, they still complete shopping through the PC terminal. The transfer of consumption habits from the former to the latter continues, but it tends to be gentler than before;

In emerging markets, with the increasing popularity of the Internet and smartphones, the number of new users is decreasing.

In 2022, China’s mobile e-commerce share is expected to be 83.4%, continuing to lead the world.

e-commerce market trends in various countries and regions in 2022

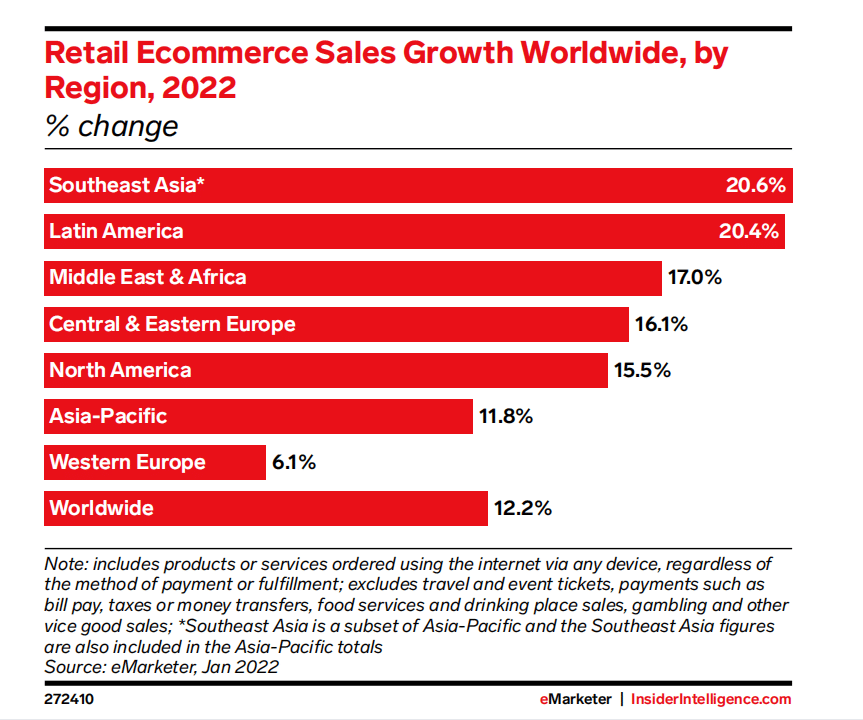

From the photo above ecommerce in Latin America and Southeast Asia are still impressive. They will be the only two regions where e-commerce sales will increase by more than 20% in 2022. In these regions, the number of online shopping groups is still increasing, and the scope of the middle class is also expanding.

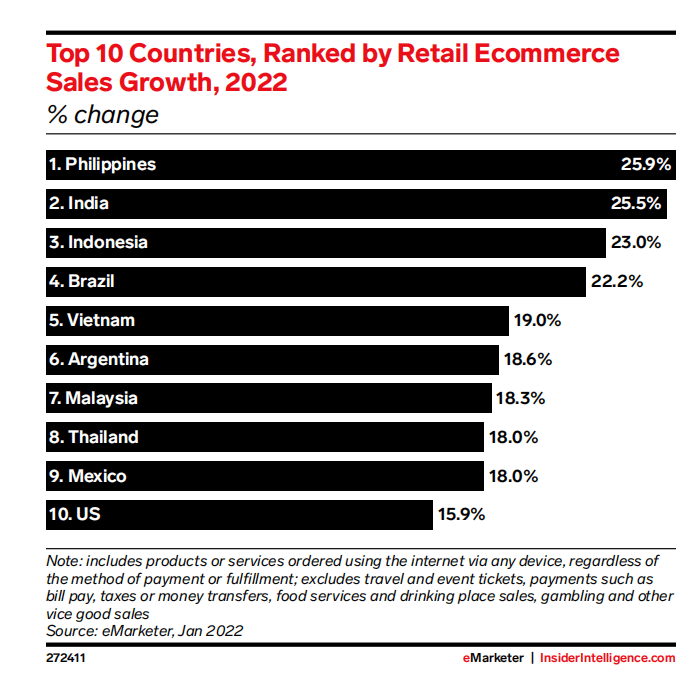

E-commerce sales growth in Asia-Pacific countries will be at the forefront. Countries such as the Philippines, India and Indonesia will lead the rest of the world in 2022. E-commerce growth in Vietnam, Malaysia and Thailand will also enter the top 10 for global development.

In the e-commerce penetration ranking, countries such as Indonesia, the United States and Brazil are climbing. China, the UK and South Korea will continue to lead the rest of the world.

The Asia-Pacific region as a whole will have a global e-commerce growth rate of 11.8% this year, which is one of the slower growth regions in the world as a whole. The pace of development will have a greater impact on the overall development of the Asia-Pacific region.

E-commerce sales in China are expected to grow 11.9% this year, the slowest pace on record. In the past ten years, the annual growth rate of Chinese e-commerce has been around 40%. But China’s digital transformation is rapidly reaching a point of maturity, and the outstanding growth scale of the past may become history.

1>Latin America: In 2022, the region will rank second in the world for e-commerce sales growth. In the future, when the growth rate of global e-commerce is relatively slow, the region can also maintain its development momentum and rank in the front row. Latin America: This region will rank second in the global e-commerce sales growth rate. In 2022, the region’s e-commerce growth rate will face a sharp drop, putting the region almost in the first place. This year, the region’s growth is expected to drop by 15 percentage points, but it is still well ahead of most other regions.

2>North America: E-commerce growth in the U.S. is surprisingly resilient. A smaller decline in economic growth is expected in the coming years.

3>Middle East and Africa: The market in many countries is still in the early stage, so its high growth stage will surpass the epidemic era in the future.

4>Western Europe: E-commerce growth in this region will reach 6.1% this year, the lowest growth level on record and the first single-digit growth rate in any region. E-commerce growth rates in most Western European countries hit record highs in 2020. And 2021 is also a year of unusually high development for the industry. The region is expected to see a sharp pullback in growth momentum in 2022.

The Asia-Pacific region ranks first in global retail e-commerce sales, and its current ranking advantage is guaranteed by the outstanding contribution of China, just as the United States has contributed to the second place in North America. The wealth of Western Europe locks it in third place. Latin America, Central and Eastern Europe, and Southeast Asia will compete for other positions in the coming decades.

In 2022, high-growth emerging markets will return to the top 10 for e-commerce sales growth, surpassing more mature markets such as Canada, Singapore, the Netherlands and Russia. Among advanced economies, only the United States is expected to rank 10th.

From the above trend we can summerize:

1>India and Philippines will battle for the top spot in the coming years.

2>No country in Western Europe is expected to see double-digit growth in e-commerce sales by 2025.

3>By 2025, e-commerce sales in each of the countries surveyed in Latin America are expected to grow, at least above 10% each year.

4> Advanced economies in China and Asia Pacific (countries such as Japan, South Korea, Australia, New Zealand, Singapore, as well as regions such as Hong Kong and Taiwan) will grow in the single digits through 2024, with growth in many of these economies remaining steady relatively low.

5>Growth in Asia Pacific will be concentrated in India and Southeast Asia going forward. In the future, the growth rate of e-commerce sales in these regions will remain strong.

In 2022, the e-commerce market will account for 20.3% of global retail sales (only 5 countries in the world will have more than 20% market share by themselves), but still indicate certain long-term trends.

By 2022, e-commerce is expected to account for double-digit market share in total retail sales in about 20 major economies around the world. While e-commerce sales are still growing across countries, most of them will eventually account for less than 15% of total retail sales.

The e-commerce industry is more popular in Northeast Asia, North America and Northern Europe.

Indonesia is eager to join the e-commerce arena, outperforming its neighbors. So is the UK.

• Outside of the top 10, major national markets in Latin America rose the fastest in the rankings.

• 5 years ago, only 10.3% of global retail sales came from retail e-commerce. Although the growth rate of global e-commerce will decline from now on, it is expected that the proportion of global retail e-commerce to total retail sales will more than double by next year.

how e-commerce sellers acquire new buyers after 2022?

In 2021, the annual growth rate of new global buyers fell below 10% for the first time in 10 years:

• In 2021, the growth rate of global online buyers is only 4.8%.

• In 2022, the global online buyer base is expected to grow by 3.4%.

• Only 85.5 million new buyers are expected to emerge in 2022. By comparison, 258.3 million people became online buyers in 2020.

Due to the epidemic, the number of online buyers will grow relatively slowly, and marketers of e-commerce sellers will have to work harder to expand the audiences scope.

By 2022, there will be 2.56 billion online buyers worldwide:

• Chinese online buyers will account for 32.9% of the global population, or 843.3 million.

• India will have 312.7 million online buyers (more than 100 million more than in the pre-pandemic era).

• The US will be in third place with 214.1 million, up 4.5 million from last year.

• No other country will have more than 100 million online buyers, but there will be 260.2 million in Latin America and 252 million in Western Europe. (This will also be the first year that Latin America has more online buyers than Western Europe).

As the digital transformation of the world matures, the ranking of online buyers in various countries will more fully reflect the overall population ranking. For a long time to come, there will still be many online buyers around the world flocking to the market.

From a regional perspective, the Middle East and Africa will be the only region in the world where the online buyer base will grow by more than 5%. Latin America will come in second with 4.6%, but Latin America will outpace the Middle East and Africa in new buyers (11.5 million: 5.4 million).

Brazil will keep pace with Latin America’s growth rate of 5.0%, relatively in line. It is also one of the few national markets in the world that can meet this threshold.

Asia Pacific is home to 59.4% of the world’s online buyers. While online buyer growth in the region will hit an all-time low of 3.8% in 2022, there will still be 55.3 million new buyers this year.

Meanwhile, India will account for more of these new buyers than any other region. But Indonesia will see the fastest growth in the region and globally at 8.8% (81.1 million buyers in the country).

In advanced economies, growth in the number of online buyers will be rather sluggish. In 2022, the buyer base in North America is expected to increase by just 5 million people, and in Western Europe by 2.7 million. The numbers in Japan (up 0.5%) and South Korea (up 0.9%) will grow more slowly than in wealthier Western countries.

Therefore, if sellers want to find first-time online buyers, they need to face a challenging market environment in the most technologically advanced countries. In contrast, despite the sharp slowdown in buyer growth in Latin America and Asia Pacific, there will still be tens of millions of new online buyers Online buyers are more accessible to sellers.

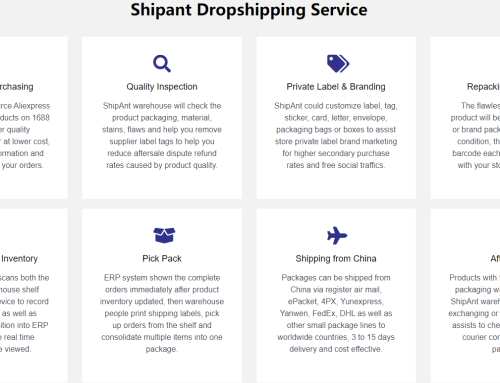

From the report, the Global retail e-commerce from 2022 to 2025 still have big potential if you select the right products for the right market, ShipAnt is a professional Chinese 3PL which offers all in one order fulfill service to help you dropship from China to worldwide countries, you are welcome to inquire ecommerce service dropship wholesale from China.

Leave A Comment

You must be logged in to post a comment.